What ArbitraX is

The goal of ArbitraX is to give serious traders and investors a single place where cross exchange arbitrage feels as simple as checking an account balance. The engine connects to multiple centralised and decentralised venues, keeps track of fees and latency and uses an AI layer to decide which opportunities are worth taking.

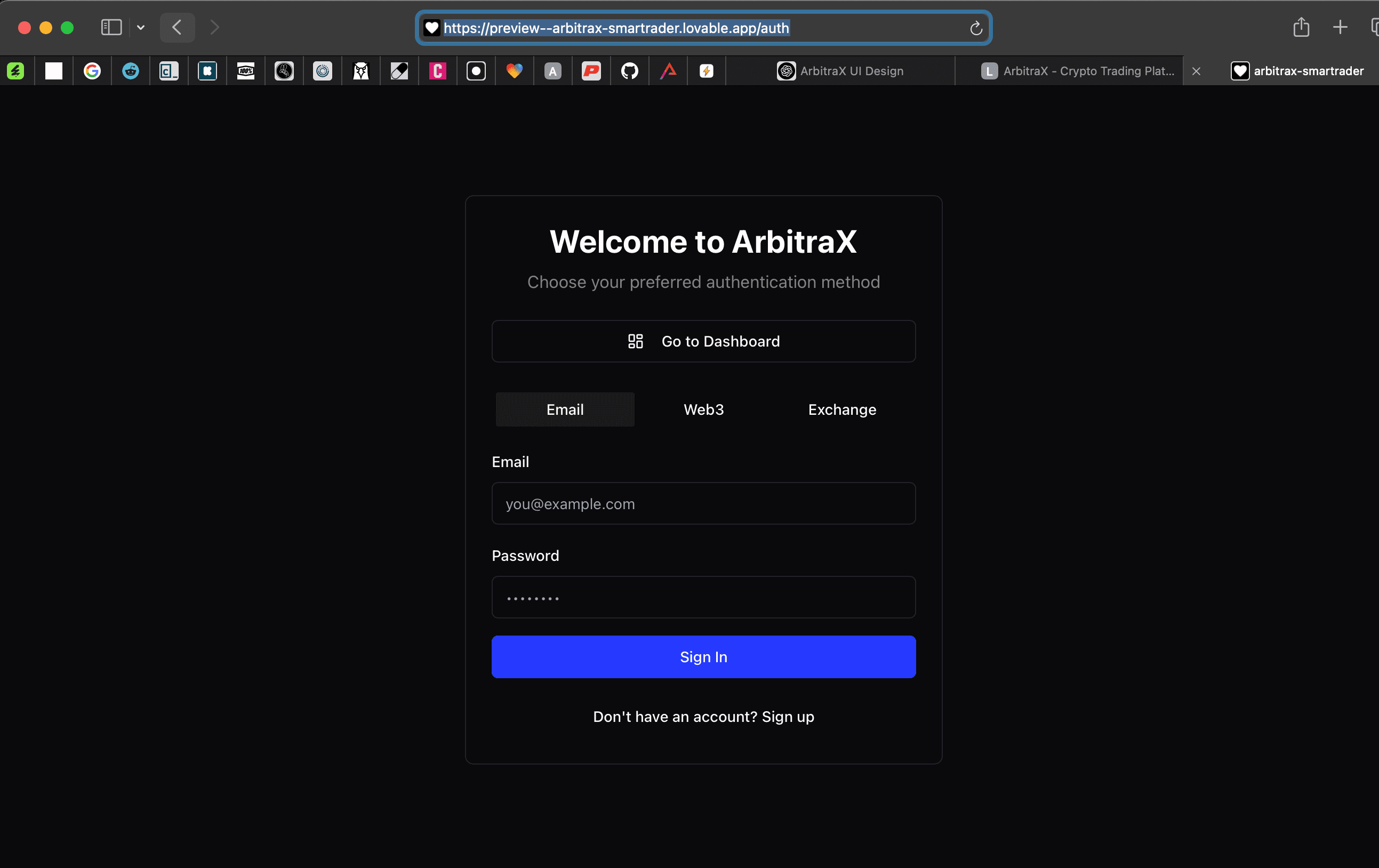

Instead of asking users to run scripts or stare at terminal windows, ArbitraX presents this as a normal dashboard with strategies, logs and risk controls. Underneath it is still a full trading system. On the surface it behaves like a product.

My role across the build

I initiated ArbitraX and have been responsible for the product from concept to working engine. That includes the visual and interaction design, the system architecture and the written material that allows engineers and investors to understand what is happening.

- Defined the product story and experience for non technical users.

- Designed the engine architecture and modular system structure.

- Developed the configuration and backtest framework for multiple trading strategies.

- Partnered with engineers on backend services, database architecture and exchange integrations.

- Designed the UI and states for dashboards, trade logs and alerts.

- Produced the business plan, investor pack and technical briefs for future collaborators.

System design

The engine follows a modular architecture that separates data collection, opportunity evaluation, execution routing, and comprehensive logging. Machine learning models assess potential trades by analyzing market conditions, while execution logic handles order routing across multiple venues. Every decision and outcome is captured in structured logs for auditing, compliance and continuous improvement.

On top of this sits the ArbitraX interface, which is designed to feel closer to a banking app than a terminal. It gives room for portfolio view, strategy toggles, performance curves and alerts without revealing unnecessary complexity.

B2B licensing and commercialisation

Once the engine and strategies were stable, the work shifted from “can this trade” to “how do we productise it”. ArbitraX is now positioned as a licensed infrastructure product for brokers, funds, fintech platforms and proprietary trading desks. Instead of running our own brokerage, the system is designed to drop into existing platforms as a white-label engine.

The licence covers the multi-strategy engine, AI orchestration layer, execution framework, risk controls and reporting architecture, with optional access to the React front end. Licensees operate under their own brand, infrastructure and regulatory permissions. ArbitraX remains non-custodial execution software rather than an investment manager.

Commercial model

- Annual SaaS or platform licences for core engine access.

- Per-account or per-seat pricing for end clients when needed.

- Volume-based or profit-share components for larger desks.

- Options for geography or asset-class exclusivity on enterprise deals.

Partner journey

- NDA and deep dive into the engine and strategy architecture.

- Review of performance data, trade logs and risk metrics from live and simulated runs.

- Technical scoping and integration plan (API-only, white-label or hybrid deployment).

- Pilot deployment, followed by full licence execution once agreed benchmarks are met.

My role here was to take a complex trading engine and turn it into something a COO, CTO or head of trading can understand in one meeting: defining exactly what is being licensed, how it plugs into their stack, and how the IP is protected through patent filings, trade-secret strategy and commercial terms.

Live trial runs

Three early ArbitraX runs, exported directly from the trading logs, showing how the engine behaves as risk is tightened, strategy mixes change and latency improves.

Trial 01

Full multi strategy shake down

+347%

- Start

- £1,000

- End

- £4,472.4

- Trades

- 79

- Win rate

- 73.0%

- Avg return

- 1.37% / trade

- Avg latency

- 103.0 ms

- Max drawdown

- 36.6%

First full engine test across all strategies.

Turned £1,000 into roughly £4,472 over 79 trades, demonstrating strong performance across multiple strategy types. Drawdown patterns from this run informed subsequent risk management improvements.

Trial 02

Risk tightened, hit rate focus

+289%

- Start

- £509

- End

- £1,980.66

- Trades

- 39

- Win rate

- 89.7%

- Avg return

- 3.91% / trade

- Avg latency

- 78.4 ms

- Max drawdown

- 0.0%

High hit rate run with a very smooth equity curve.

With tighter risk limits the engine delivered an 89 percent win rate and the highest average return per trade, with almost no giveback from prior peaks.

Trial 03

Long biased trend run

+273%

- Start

- £531

- End

- £1,980.66

- Trades

- 72

- Win rate

- 88.9%

- Avg return

- 3.33% / trade

- Avg latency

- 62.6 ms

- Max drawdown

- 53.3%

Long biased, breakout heavy test with faster latency.

Demonstrates how trend-following strategies can drive higher returns per trade while managing deeper drawdowns through improved latency and execution speed.

Combined view

Three trials, one picture of the engine

Across all three runs, ArbitraX grew a combined £2,040 test book to around £8,434 with an eighty two percent win rate and sub one hundred millisecond average latency.

- Total return

- +313%

- Combined balance

- £2,040 → £8,433.72

- Trades

- 190

- Win rate

- 82.6%

- Avg return

- 2.64% / trade

- Avg latency

- 82.5 ms

Where the project is now

ArbitraX now has a deployable engine, configuration files, trial data and a full B2B licensing pack: commercial models, integration options and an IP strategy built around patent filings, trade secrets and contractual protection. The focus moving forward is using this to open structured conversations with brokers, funds and fintech platforms, running pilots before scaling licences.

For me as a designer-founder, this project is about more than UI. It is about turning a complex AI trading system into a product that can live inside other people's businesses – with clear lines around risk, compliance and governance – while still feeling as simple and confident as any good consumer app.